Data shows that in the first half of 2023, Bitcoin increased by 83.8%, ranking first, far exceeding other major assets in the world.

The Nasdaq index rose 31.7%, ranking second, and other major national stock markets rose. The price of natural gas fell by 37%, ranking the… pic.twitter.com/bou05S8aH0

— Wu Blockchain (@WuBlockchain) July 2, 2023

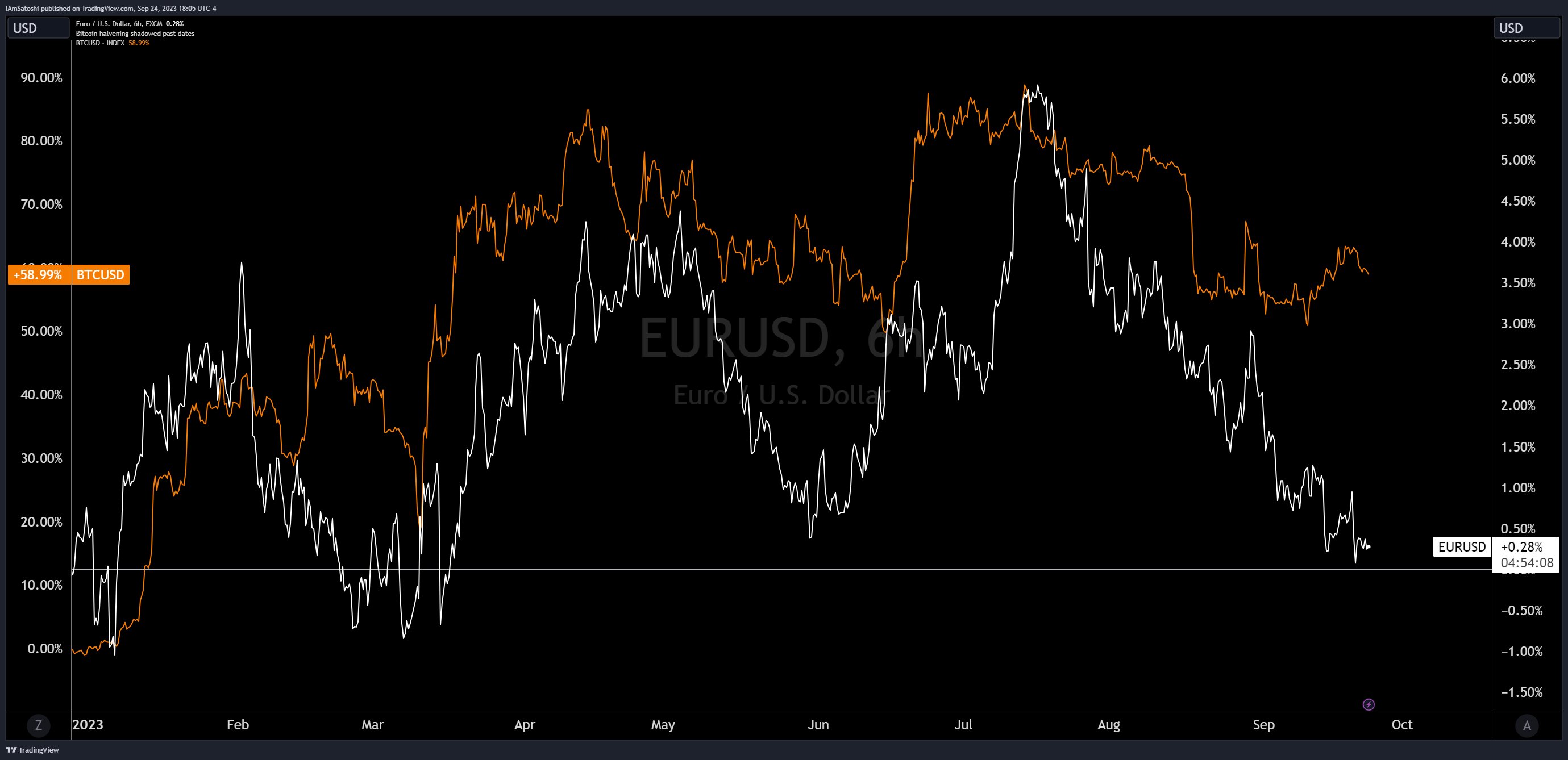

Bitcoin’s trajectory for 2023 has been clear and with a bullish undertone. The flagship cryptocurrency kicked off the year with a strong bullish sentiment. The bitcoin price rose by 47% within the first month of the year, setting the tone for the following weeks.

The cryptocurrency’s rise was characterized by typical declines, with support and resistance levels impacting the price change. Bitcoin’s price dropped to $19,569 in March after climbing over $25,000 for the first time since August 2022.

Many Bitcoin analysts identified the climb above $25,000 as a significant move to confirm the end of the bear market. Despite the pullback after that, the majority of Bitcoin’s proponents considered it a consolidation and an accumulation opportunity. That belief was supported by the anticipation of a bull run ahead of the next Bitcoin halving, which comes up in 2024.

Another phase of the bullish trend returned to the Bitcoin market in the middle of March. Bitcoin gained over 58% in about four weeks during that period, as the price surpassed the $30,000 level for the first time since June 2022.

After that surge, Bitcoin entered into another consolidation, pulling back toward the $25,000 support region. After reaching a local low of $24,756, the bullish momentum returned, with the price returning above the $30,000 price level.

Data from TradingView shows that Bitcoin’s price at the end of June was $30,469, marking a yearly gain of over 83%. Bitcoin traded at $30,503 at the time of writing, with the positive momentum still intact.

Visit leading cryptocurrency exchanges:

#1 OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2 ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3 Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4 MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5 KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6 Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7 Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog: https://sites.google.com/view/my-crypto-jam/

=)

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NXY2IUUC2NG5BDIGPCRD25D27A.png)