Bitcoin Stands a Good Chance of Surging Higher, According to

Blockchain analytics platform Santiment says that the odds are Bitcoin (BTC) will soon move to the upside due to one factor.

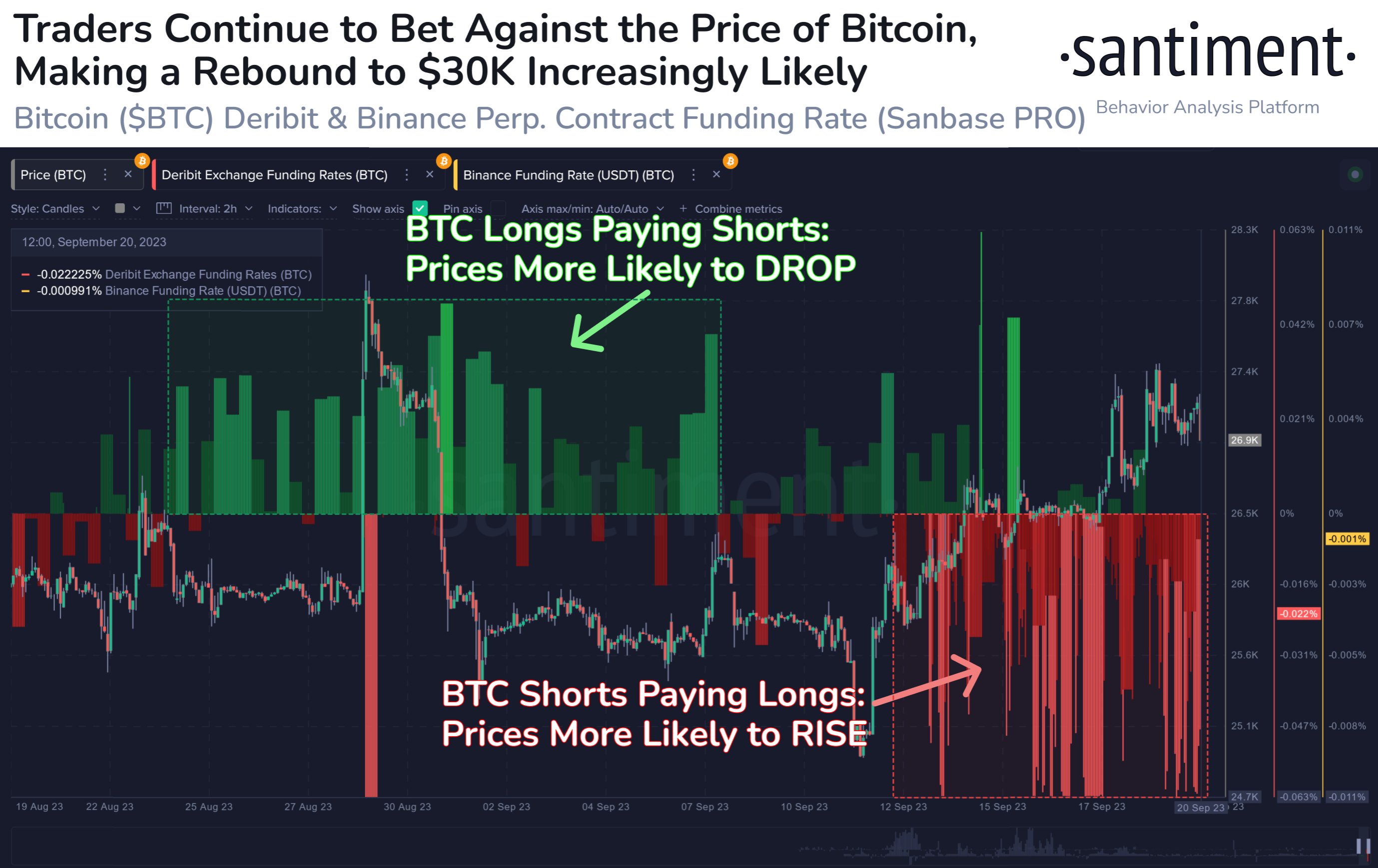

The analytics platform says that Bitcoin is seeing a lot of short interest on two major crypto exchanges, which could set the stage for a short squeeze and send BTC beyond $30,000.

“Bitcoin traders are aggressively shorting on both Deribit and Binance, making potential liquidations more likely to boost prices. BTC’s price is +4% since the increase in shorting began to appear last week. This has a good probability of continuing.”

Source: Santiment/X

A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

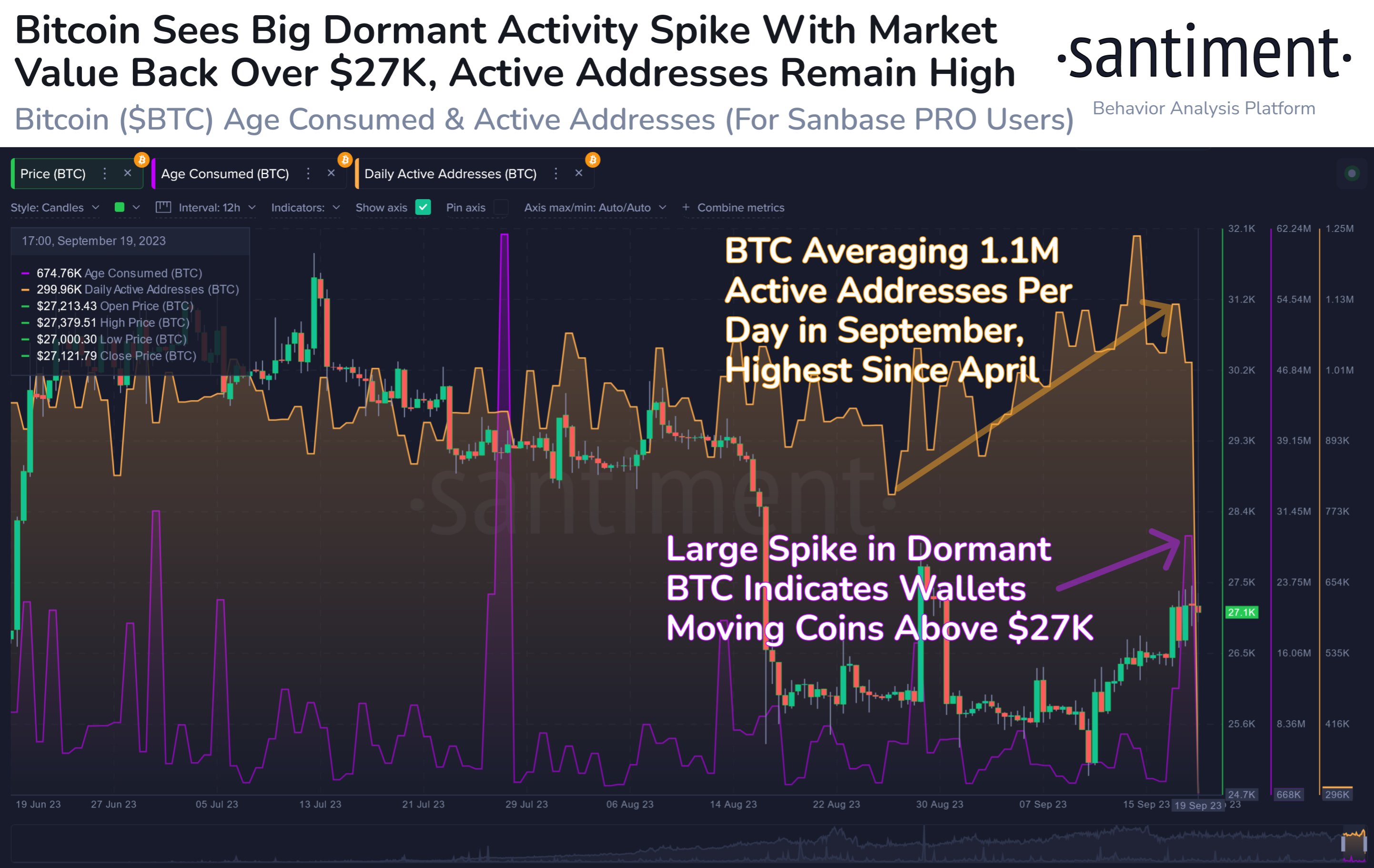

Santiment also says that Bitcoin’s network activity shot up this month as BTC crossed the $27,000 level.

“Bitcoin’s on-chain activity continues to be significantly higher than it has been since April. Utility is notably higher, and the third largest day [of activity] in dormant BTC in three months also occurred yesterday. The low $27,000 level is proving to be polarizing.”

Source: Santiment/X

The analytics firm is keeping a close eye on how many stablecoins deep-pocketed crypto investors are holding. An increase after a period of decline could indicate Bitcoin will move to the upside, according to Santiment.

“Whales have been dropping stablecoins, indicating that their buying power isn’t quite as strong as when Bitcoin was above $30,000 back in June. [Holdings are] now at the lowest level in six months. Look for $5 million+ whale wallets to increase again to signal a turnaround.”

Source: Santiment/X

Bitcoin is trading for $26,588 at time of writing, down 2.2% in the last 24 hours.

Cryptocurrency exchanges review:

#1 OKX - 24h Volume: $ 1 097 255 972.

OKX is an Hong Kong-based company founded in 2017 by Star Xu. Not available to users in the United States.

#2 ByBit - 24h Volume: $953 436 658.

It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit works in over 200 countries across the globe with the exception of the US.

#3 Gate.io - 24h Volume: $ 643 886 488.

The company was founded in 2013. Headquartered in South Korea. Gate.io is not available in the United States.

#4 MEXC - 24h Volume: $ 543 633 048.

MEXC was founded in 2018 and gained popularity in its hometown of Singapore. US residents have access to the MEXC exchange.

#5 KuCoin - 24h Volume: $ 513 654 331.

KuCoin operated by the Hong Kong company. Kucoin is not licensed to operate in the US.

#6 Huobi - 24h Volume: $ 358 727 945.

Huobi Global was founded in 2013 in Beijing. Headquartered in Singapore. Citizens cannot use Huobi in the US.

#7 Bitfinix - 24h Volume: $ 77 428 432.

Bitfinex is located in Taipei, T'ai-pei, Taiwan. Bitfinex is not currently available to U.S. citizens or residents.

My bitcoin-blog: https://sites.google.com/view/ripple-xr ... al-growth/

=)